Drinks professionals are raising a glass to Chancellor Rishi Sunak this afternoon after the budget announcement that alcohol duty will be frozen.

This is music to the ears of professionals working in the drinks trade, who have been lobbying the Government to freeze the duty following the impacts of COVID-19 on business.

Last week, Conservative MPs wrote to Sunak arguing that a cut in beer duty would help to support pubs struggling to make a comeback.

Michael Saunders, Chief Executive Officer of London-based alcohol importer Bibendum Wine, said: “Hospitality businesses have been one of the hardest hit from COVID-19 and we are pleased that the Government has decided to freeze duty on wine and spirits.

“It’s fantastic to see support from the Government, especially for pubs, restaurants, hotels and their suppliers in what has been an extremely difficult year for our industry.

“Also we pay tribute to the WSTA team (the Wine and Spirit Trade Association) for their tireless work on our industry’s behalf in getting our message to the Government, benefiting all consumers of wines and spirits.”

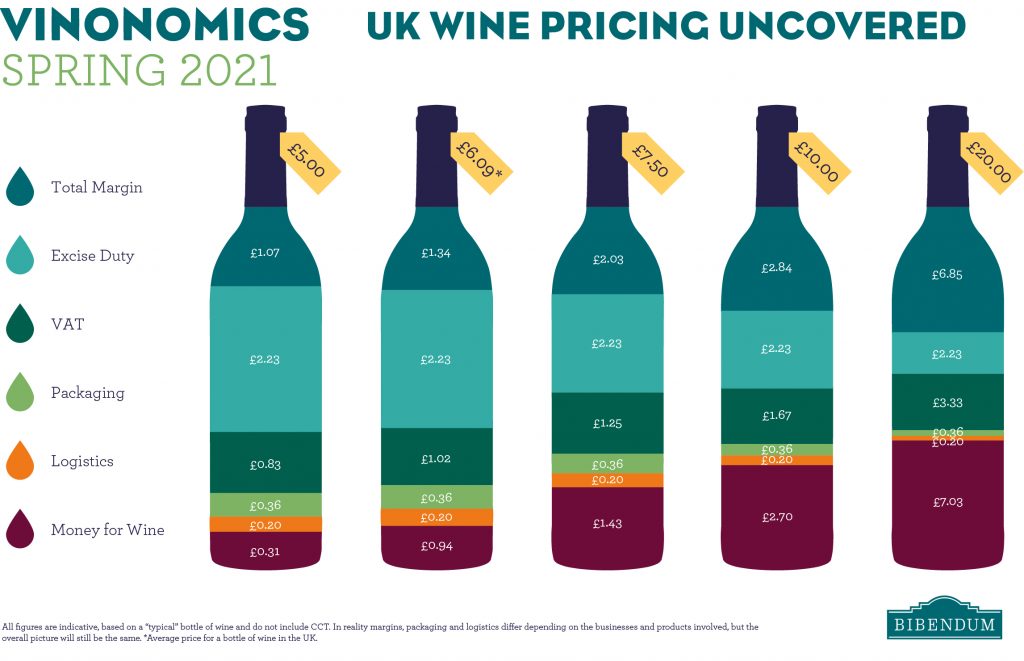

Following the budget announcement, duty on wine will remain at £2.23 per bottle.

But there’s a lot more that goes into the cost of a bottle of wine than duty, including packaging, logistics, and of course paying the farmer.

Many of these factors do not change, so when slightly more is spent on a bottle of wine the quality of the wine inside increases considerably.

Bibendum examines the details in this infographic:

When buying a £5 bottle of wine in the UK, 31p goes towards paying for the wine itself.

When buying a £10 bottle of wine in the UK, £2.70 goes towards paying for the wine.

For a £20 bottle, £7.03 is spent on wine, so despite costing four times the amount of a £5 bottle, the quality of the wine increases nearly 23 times.

However, some are concerned by raised levels of drinking in the UK during the pandemic.

As South West Londoner reported last week, Alcohol Change UK said the costs to society of drinking are “massively out of proportion” to the tax paid on it.

Miles Beale, WSTA CEO, told Decanter that the decision to freeze wine and spirit duty has come as a huge relief for British businesses, pubs and restaurants.

He said: “Chancellor Rishi Sunak seems to ‘get it’. He understands that supporting our industry will allow it to recover, rebuild, create jobs and – in time – replenish revenues to the Treasury.

“We will all raise a glass to the chancellor tonight – and look forward to more permanent support for the sector following the review of alcohol taxation.”