UK businesses fleeing to The Netherlands to ‘dodge rising taxes’ has soared by 320% in the last decade – and campaigners warn Rachel Reeves’ tax bombshell budget will only make it WORSE.

New figures from BoldData reveal a stark rise in UK-owned holdings in the Netherlands, apparently eager to reduce tax obligations through ‘mailbox firms’ or shell companies.

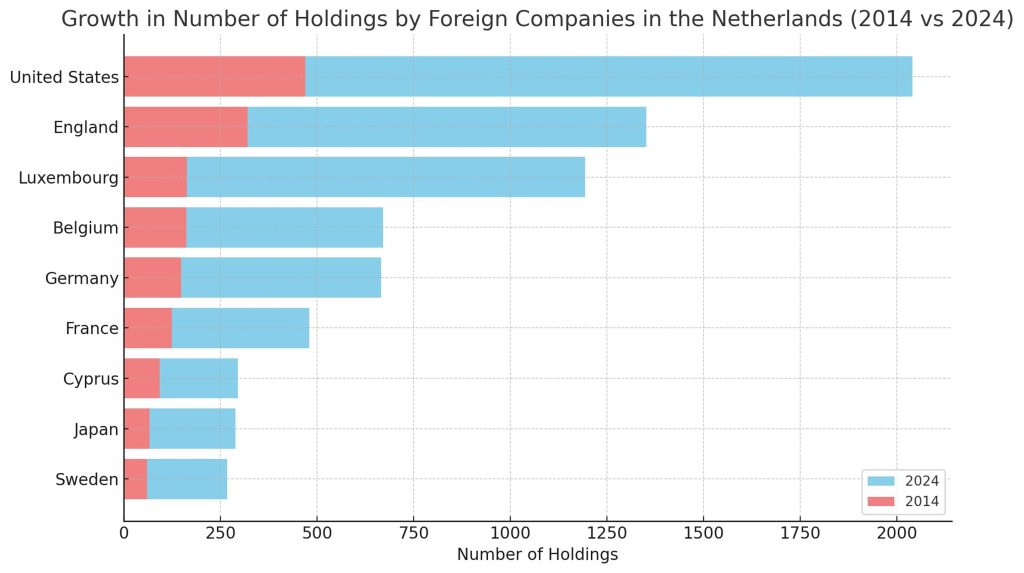

Data shows that the number of UK-owned holdings operating in the Netherlands has risen from 320 in 2014 to 1,352 in 2024 – a growth of more than 320%.

This shift is believed to be driven by rising tax pressures in the UK, with the Netherlands offering a more favourable environment for strategic tax positioning and cross-border business.

The new figures come as Chancellor of the Exchequer Rachel Reeves announced she would raise employers’ national insurance contributions in the Autumn budget’s £40billion tax bombshell.

Reeves said that employees would not pay more directly, but employers’ national insurance would hike by 1.2 percentage points to 15 per cent from April.

Campaign group the Taxpayers’ Alliance believes the chancellor’s tax hike will only drive more businesses into the arms of lower tax countries.

Elliot Keck, head of campaigns at the TaxPayers’ Alliance said: “Taxpayers will be concerned about companies closing up and leaving.

“The chancellor’s hike in employer’s national insurance will only drive more wealth creators and businesses into the arms of lower tax countries.

“Rachel Reeves needs to be supporting businesses not slamming them.”

BoldData said that The Netherlands’ ‘reputation as a “tax-efficient” jurisdiction has made it an appealing base not only for major international corporations but also for smaller firms seeking to streamline tax exposure’.

The Netherlands has seen a rapid increase in foreign-held holdings over the past decade. Since 2014, the number of UK-owned holdings alone has quadrupled.

The United States also leads with more than 2,000 holdings, while smaller economies like Cyprus have observed the most dramatic rise, with foreign holdings increasing by more than 700% in 15 years.

For more information and to see the full statistics of the study, please visit https://bolddata.nl/en/companies/world/holdings/

Image credit: Free to use under the Unsplash License.