Every Year 7 living in Merton has been offered a free £20 deposit by the council when they open a savings account with Croydon Plus credit union.

The first-of-its-kind scheme is funded through the council’s £2 million Cost-of-Living Fund and can be accessed by an estimated 2,500 eligible children.

The initiative aims to begin young people’s savings allowing them to be better-off financially in the future, and, along with educational resources, to also instil good saving and money management habits.

Peter Robinson, chief operating officer of Croydon Plus, grew up in Croydon and left a 30-year job at a global bank to manage the credit union.

He said about being part of the scheme: “I’m immensely proud; it’s just so nice to help people.

“It’s not about making money, it’s about saving lives and improving people’s welfare.

“I’d love to see the children add to that balance.

“If they can look at their balance every month and just see it grow, grow, grow, they won’t want to touch it, giving them a financial foothold and getting them thinking about the future.”

The money is available to any student born between 1/9/2011 and 31/8/2012, the account is also locked until they turn 16.

This comes after many families have struggled with not having savings to fall back on due to the pandemic and rising inflation.

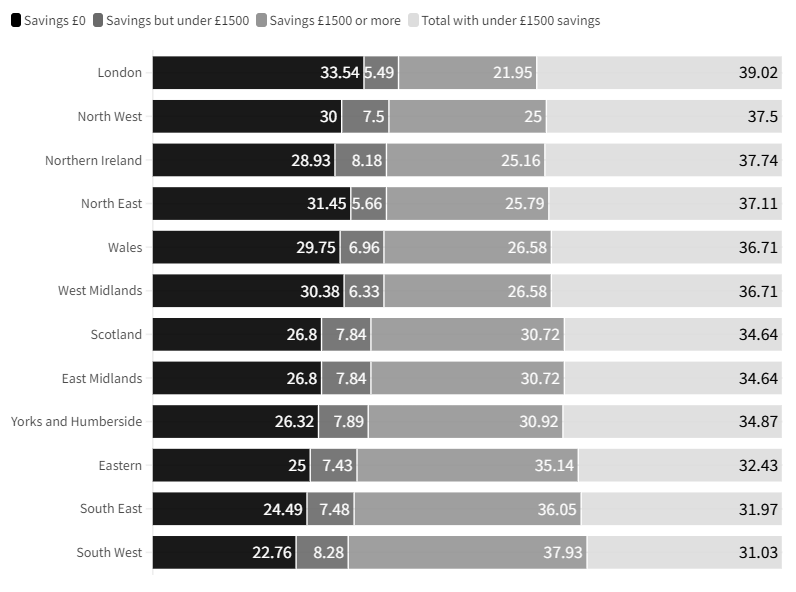

Data from the Money and Pension Service, an advisory body to the Department for Work and Pensions, shows that 26% of UK adults have less than £100 in savings, while Department for Work and Pensions data from 2019 identified London as the region with the greatest percentage of families with no savings.

By teaching the importance of saving at an early age, the scheme aims to create a generation more financially resilient to future cost-of-living challenges.

Victoria Copeland, MaPS Regional Partnerships Manager for West London, who supports the scheme, said: “We learn about money at a very young age; we learn about how to deal with it or how not to deal with it.”

“So educating people to manage money, to handle money, and to develop good habits really can’t start early enough.”

“If you can instil this behaviour in young people, the expectation is that they’ll grow up to be life-long and regular savers.”

A study by GoHenry and Development Economics found that 40% of those with no financial education had no savings at all, and were up to £70,000 less well-off in retirement.

It also found that UK adults who didn’t receive financial education when they were younger were more likely to be unemployed, or earning less today, than those who did.

The educational resources will partly take the form of assemblies in schools, which will also be available to young people outside of year 7.

Louise Hill, co-founder & CEO of GoHenry, a debit card for under-18s, said: “Instilling good saving behaviours from a young age is vital for kids to shape positive habits that can last a lifetime.”

Before opening a Merton Young Savers’ account with Croydon Plus, a guardian must open their own account with the credit union.

Hill and Robinson hope that adults and children will save alongside each other and start conversations about money at home which might not otherwise happen.

However, Hill wishes to see further action taken, introducing compulsory financial education as a standalone subject in schools and replicating the scheme in other boroughs.

Hill also recommended the following tips for young savers:

- Save little and often.

- Set clear goals.

- Celebrate the milestones.

- As well as saving, budgeting is crucial.

Featured image credit: Carissa Rogers via Flickr